alienexpress.ru

Learn

Best Bank To Have A Debit Card With

A debit card looks like a credit card but works like an electronic check. Why? Because the payment is deducted directly from a checking or savings account. No matter what you need, we have an account that works for you. All our checking accounts come with mobile and online banking, a contactless debit card so you. We picked the Axos Bank Rewards Checking account as the best overall bank checking account due to its strong APY and lack of fees. Not only does it pay up to 3. Apply for a Discover Cashback Debit account without impacting your credit score. · Start earning 1% cash back today · Bank with a no-fee checking account · Get. Commerce Bank makes student banking easy by offering student checking, savings, credit cards and auto loans. Open an account online or in a branch. Made to make student life just a little easier. A convenient way to access your money on and off campus, plus exclusive benefits with a Campus Card linked to an. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Maximum balance for top APY: % APY up to $25,, and % APY on balances beyond $25, Debit card transactions required per month: Seven or more. Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn. A debit card looks like a credit card but works like an electronic check. Why? Because the payment is deducted directly from a checking or savings account. No matter what you need, we have an account that works for you. All our checking accounts come with mobile and online banking, a contactless debit card so you. We picked the Axos Bank Rewards Checking account as the best overall bank checking account due to its strong APY and lack of fees. Not only does it pay up to 3. Apply for a Discover Cashback Debit account without impacting your credit score. · Start earning 1% cash back today · Bank with a no-fee checking account · Get. Commerce Bank makes student banking easy by offering student checking, savings, credit cards and auto loans. Open an account online or in a branch. Made to make student life just a little easier. A convenient way to access your money on and off campus, plus exclusive benefits with a Campus Card linked to an. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Maximum balance for top APY: % APY up to $25,, and % APY on balances beyond $25, Debit card transactions required per month: Seven or more. Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn.

The Kiplinger Best Financial Customer Service rankings gave U.S. Bank The U.S. Bank Visa ® Debit Card is issued by U.S. Bank National Association. Unlimited ATM fee rebates apply to cash withdrawals using the Schwab Bank Visa® Platinum Debit Card wherever it is accepted. Schwab Bank makes its best effort. Unlimited ATM fee rebates apply to cash withdrawals using the Schwab Bank Visa® Platinum Debit Card wherever it is accepted. Schwab Bank makes its best effort. Huntington offers special debit card features to help you decide which type is best for you. Can you have a debit card without a checking account? Yes. If. See NerdWallet's picks for the Best Checking Accounts of September These accounts have low fees and consumer-friendly features. Compare Checking Accounts. Previous. Account description1. Best for2. Benefits Debit Card or ATM Card and use of Comerica ATMs. Check Safekeeping4. View. A savings account is also a good place to build and stash your emergency fund. Most also come with checks or a debit card, making them like a hybrid savings-. debit, a virtual card that that can be accessed anytime in Mobile Banking. The digital card for debit is designed for you to always have access to your. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals! Every TD Checking Account comes with a free Visa® Debit Card: One card, so many ways to pay – make purchases and pay bills in person, online, over the phone or. Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more. Or, suppose you don't realize you have only $ in your bank account and you want to use your debit card to buy a $ item. Depending on the terms of your. Log in to Online Banking; Report your lost or stolen debit card via the Mobile Banking app. This is the best way to minimize your potential losses. You may. debit card immediately takes the money from your connected bank account to pay for purchase. For example, if you have $ in your checking account, and pay. debit card highlighting the convenience of using a checking account for every. Not sure which checking account is the best fit? Compare all checking accounts. Find the best way to bank for you with detailed information on bank types, services, and fees. Browse Investopedia's expert-written library to learn more. Open up a teen checking account with a contactless debit card, get no minimums and ATM rebates up to $20 Best Teen Checking Account. Forbes. A debit card is a payment card that deducts money directly from your checking account to pay for purchases instead of using cash. You can also use it to get. Some bank accounts provide you with a debit card you can use to shop online. If your account is with an FDIC-insured bank, federal law limits your loss in the.

Start A Private Equity Firm

Private equity professionals can advance fast within a firm and typically start as junior associates or analysts. Junior associate/analyst: Employees in entry-. Private equity firms typically invest in privately-held companies and/or assets which aren't traded on public markets. Founders will look to private equity. At least as important, private equity firms are skilled at selling businesses, by finding buyers willing to pay a good price, for financial or strategic reasons. Private-equity capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel. KPS Capital Partners, LP is a global and renowned private equity firm with exclusive expertise in investing across a range of manufacturing industries. Private equity firms typically look for certain key factors when considering investment opportunities. Some of these factors include: A strong management team. A private equity fund is a pooled investment vehicle created for investments in equity securities and real estate. This white paper discusses some of the. That's where private equity firms come in. They invest in, well, private equity (another term for shares in a company). That can take the form of “venture. Private equity firms raise client capital to launch private equity funds, and operate them as general partners, managing fund investments in exchange for. Private equity professionals can advance fast within a firm and typically start as junior associates or analysts. Junior associate/analyst: Employees in entry-. Private equity firms typically invest in privately-held companies and/or assets which aren't traded on public markets. Founders will look to private equity. At least as important, private equity firms are skilled at selling businesses, by finding buyers willing to pay a good price, for financial or strategic reasons. Private-equity capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel. KPS Capital Partners, LP is a global and renowned private equity firm with exclusive expertise in investing across a range of manufacturing industries. Private equity firms typically look for certain key factors when considering investment opportunities. Some of these factors include: A strong management team. A private equity fund is a pooled investment vehicle created for investments in equity securities and real estate. This white paper discusses some of the. That's where private equity firms come in. They invest in, well, private equity (another term for shares in a company). That can take the form of “venture. Private equity firms raise client capital to launch private equity funds, and operate them as general partners, managing fund investments in exchange for.

Most firms will have a vision for how the company will grow and what to focus on for the investment. Some companies may focus on margin expansion and begin. Private equity firms typically invest in privately-held companies and/or assets which aren't traded on public markets. Founders will look to private equity. The average PE firm evaluates 80 deals before investing in a single company—and closing a deal takes an average of 20 meetings, four negotiations with target. private equity firm would seek? Let's start with the matter of cash on hand. Is There Too Much Cash on the Balance Sheet? One of the hallmarks of private. You are not crazy. It's doable. Most PE firms or partnerships started as small outfits and grew over time. Hedge Funds: Hedge fund professionals manage pooled funds by trading a variety of financial instruments, such as equities, bonds, and derivatives, to generate. Launching a private equity fund involves navigating various regulatory complexities and business challenges. A private equity fund encompasses unique securities. Raising a fund can take substantially longer than raising money for a single investment. Depending on interest from investors and the timeline to complete. Investors participating in private equity funds have to commit a certain sum for a fixed period (5 – 10 years). Some firms have an entry cap of $K. This. The outside investors or Limited Partners might include pension funds, endowments, insurance firms, family offices, funds of funds, sovereign wealth funds, and. This article introduces the contemporary structure of private equity real estate funds and outlines the steps necessary to create and properly manage a fund. 1. Find seed money for your new firm: can be your capital, your partners', family and friends, or a professional investor/former client. · 2. A private equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or. Hedge Funds: Hedge fund professionals manage pooled funds by trading a variety of financial instruments, such as equities, bonds, and derivatives, to generate. Independent private equity and venture capital firms typically raise money from institutional investors such as pension funds, insurance companies and family. Accredited investors and qualified clients include institutional investors, such as insurance companies, university endowments and pension funds, and high. Private equity firms, portfolio companies and investment funds face complex challenges. How private equity firms can leverage AI to create value. You'll need to decide what type of firm you want to start, what services you'll offer, and how you'll market your business. Having used due diligence to develop a clear picture of the company which has been acquired, the private equity firm will aim to leverage the findings to create. life of a fund. • During the interval between initial closing and final closing, some investments may be made and thus the investment period starts.

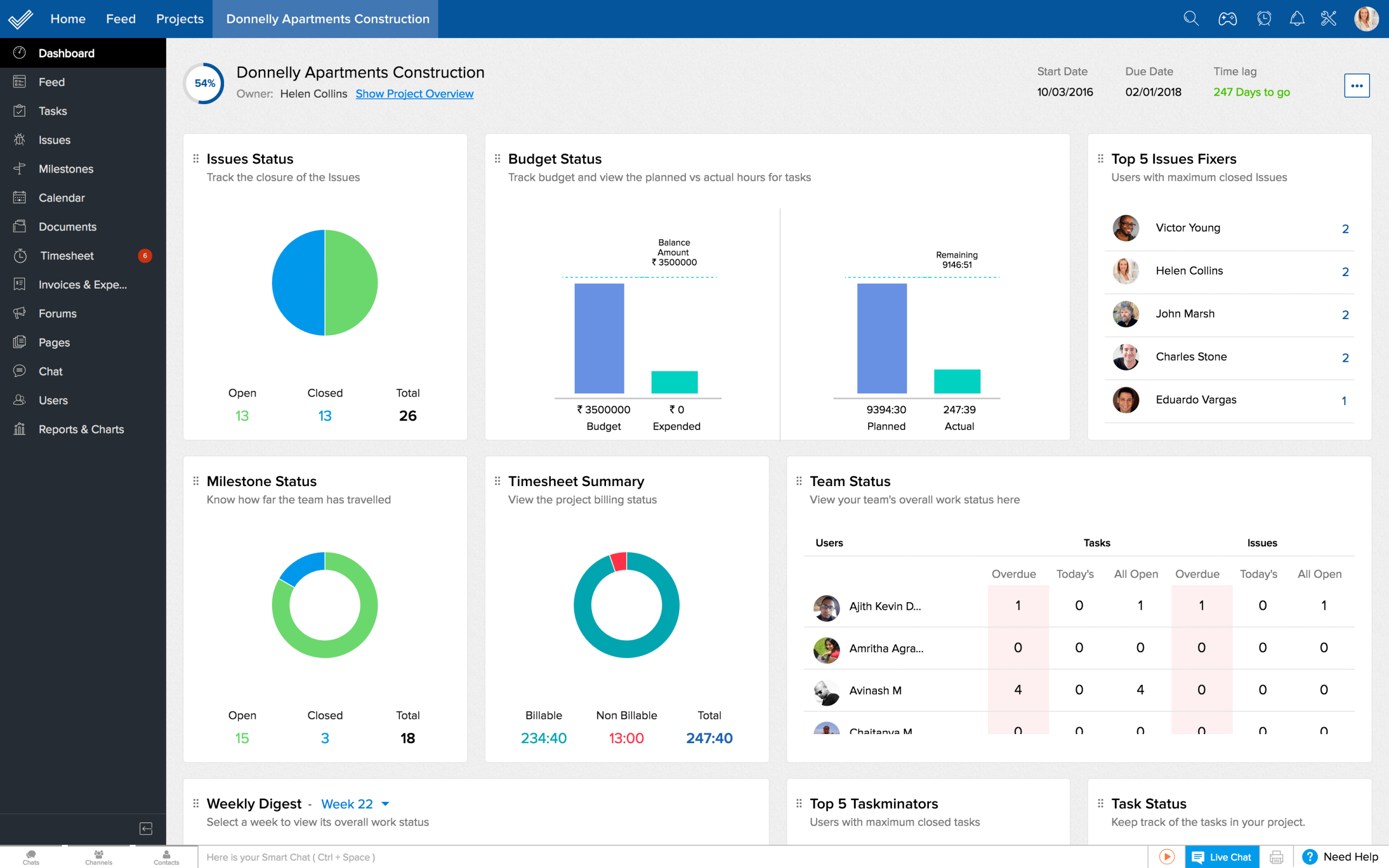

Google Project Planning Tools

Asana is one of the more popular project management software platforms available. Built for businesses of many sizes, this multifaceted tool combines file. Consolidate all projects, tasks, deadlines, requests, approvals, notes, and reminders into one single source of truth. Track, update, and collaborate on project tasks. Create dynamic project plans and Gantt charts in Sheets to manage your projects, assignments, and deadlines. Today's Leading Cloud-based Project Management Software. With Google Drive and G-Suite integration, Open and Edit MS Project MPP Files, and a day Free. Project Management. Create, update, and delegate tasks, right in Slack. Keep projects moving forward with these apps. Get more done with the Google Tasks mobile app. Manage, capture, and edit your tasks from anywhere, at anytime, with to-dos that sync across all your. Create a project plan. Track, update, and collaborate on project tasks with your team in a shared spreadsheet. Deliver projects like a pro Your projects may be complex, but your project management tools don't have to be. Combine a rich set of features with flexibility. Trello is simple project management software that gives you a way to organize your projects with Kanban boards. And with a generous free plan that allows for Asana is one of the more popular project management software platforms available. Built for businesses of many sizes, this multifaceted tool combines file. Consolidate all projects, tasks, deadlines, requests, approvals, notes, and reminders into one single source of truth. Track, update, and collaborate on project tasks. Create dynamic project plans and Gantt charts in Sheets to manage your projects, assignments, and deadlines. Today's Leading Cloud-based Project Management Software. With Google Drive and G-Suite integration, Open and Edit MS Project MPP Files, and a day Free. Project Management. Create, update, and delegate tasks, right in Slack. Keep projects moving forward with these apps. Get more done with the Google Tasks mobile app. Manage, capture, and edit your tasks from anywhere, at anytime, with to-dos that sync across all your. Create a project plan. Track, update, and collaborate on project tasks with your team in a shared spreadsheet. Deliver projects like a pro Your projects may be complex, but your project management tools don't have to be. Combine a rich set of features with flexibility. Trello is simple project management software that gives you a way to organize your projects with Kanban boards. And with a generous free plan that allows for

Manage, capture, and edit your tasks from anywhere, at anytime, with to-dos that sync across all your devices. Integrations with Gmail and Google Calendar help. Manage, capture, and edit your tasks from anywhere, at anytime, with to-dos that sync across all your devices. Integrations with Gmail and Google Calendar help. Project management software for SMB that enables your teams to collaborate, plan, analyze and deliver projects with success. Get started for free – plans. A project management tool that your whole team will actually love using. The easy way to organize, plan and track progress on your projects. The Google project management tools are on board. · Google Drive · Google Sheets · Google Docs · Gmail · Google Meet · Google Chat · Google Calendar · Google. monday work-management logo. #1 WORK MANAGEMENT SOFTWARE ON G2. Manage everything from strategy to tasks to exceed your goals ; monday CRM logo. G2 LEADER FOR. The top five project management tools for project teams in · Gantt charts · Work breakdown structure · Project baseline · Team-building. Get started in the high-growth field of project management with a professional certificate developed by Google. Discover how to manage projects efficiently and. Google Sheets project management templates provide a framework to guide you through the planning, execution, monitoring, and assessment stages of your project. Made for complex projects or everyday tasks · ⚡ Plan and organize tasks · Align work to goals · Track work your way · Optimize with insights. Essential Google Workspace Tools for Project Management · Google Drive for document management · Google Sheets for project tracking · Google Calendar for. Operationalize goals. Connect work to company goals. Automate workflows across departments ; Meet campaign goals. Streamline campaign management. Enhance. Brainstorm, take meeting minutes, and create project proposal documents in the same place you build workflows. Embed boards and dashboards directly where you. Many of the project management apps we've reviewed are easy to use, provide good video tutorials, and work well for beginners, but after testing dozens of them. Trusted by millions, Basecamp puts everything you need to get work done in one place. It's the calm, organized way to manage projects, work with clients. Offered by Google. Get on the fast track to a career in project management. In this certificate program, you'll learn in-demand skills at. Open source project management software for classic, agile or hybrid project management: task management✓ Gantt charts✓ boards✓ team collaboration✓ time and. Like ClickUp, you can add attachments, links, and images, create checklists, connect with your Google account, and more. This project management tool can help. Use Gmail, Google's email service, to create a custom email addresses for internal and external communication. Schedule meetings, events, and due dates using. This article presents the Project Management Tools that are available to chapters to aid in the planning and management of projects Google Drive. Project.

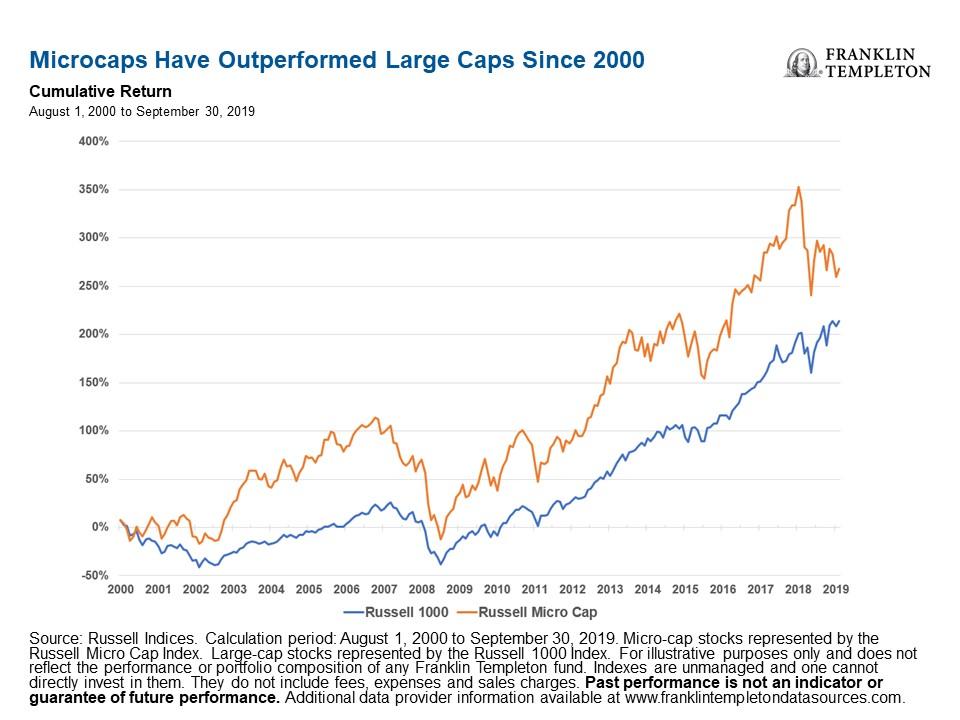

What Is Microcap Stock

We define microcap stocks as those trading on U.S. exchanges with an inflation-adjusted market capitalization between $50 million and $ million.1 Also, our. Seeking Alpha's latest contributor opinion and analysis for investors interested in micro-cap stocks. Click to discover ideas, strategies, and analysis. Micro-cap stocks are small companies that trade on public exchanges such as the New York Stock Exchange and the Nasdaq. While there is no industry-accepted. Shares of microcap or "penny" stock represent fractional ownership of a corporation in companies with limited assets or "capitalization.". A micro-cap is a small company that has a market capitalization between $50 million and $ million and is considered riskier than a large-cap stock. We are a value oriented, bottom up, microcap stock-picking strategy. We define microcap stocks as companies with market capitalizations in the bottom two. Microcap is a general term used to define stocks with a market capitalization of between $50 million and $ million. · Microcap stocks are usually traded over-. Ever since stock markets were created, investors have been devising schemes to enable them to beat the market's average return. Some invest in large companies. Publicly-available information about microcap stocks (low-priced stocks issued by the smallest of companies), including penny stocks (the very lowest priced. We define microcap stocks as those trading on U.S. exchanges with an inflation-adjusted market capitalization between $50 million and $ million.1 Also, our. Seeking Alpha's latest contributor opinion and analysis for investors interested in micro-cap stocks. Click to discover ideas, strategies, and analysis. Micro-cap stocks are small companies that trade on public exchanges such as the New York Stock Exchange and the Nasdaq. While there is no industry-accepted. Shares of microcap or "penny" stock represent fractional ownership of a corporation in companies with limited assets or "capitalization.". A micro-cap is a small company that has a market capitalization between $50 million and $ million and is considered riskier than a large-cap stock. We are a value oriented, bottom up, microcap stock-picking strategy. We define microcap stocks as companies with market capitalizations in the bottom two. Microcap is a general term used to define stocks with a market capitalization of between $50 million and $ million. · Microcap stocks are usually traded over-. Ever since stock markets were created, investors have been devising schemes to enable them to beat the market's average return. Some invest in large companies. Publicly-available information about microcap stocks (low-priced stocks issued by the smallest of companies), including penny stocks (the very lowest priced.

Microcap stock frauds aim to sell or “swindle” unwitting investors into buying what seems to be legitimate stock. Microcap insiders who know of microcap stock. You should consider investing in microcap stocks because a set of well-chosen microcap stocks can make a real difference to your net worth while keeping. A microcap stock is a publicly traded company that has a market capitalisation which is lower than small, mid, and large-cap stocks. microcap stocks listed or permitted to trade on NSE. The index includes the A stock's weight is based on its free-float market capitalization. Microcap stock (also micro-cap) refers to the stock of public companies in the United States which have a market capitalization of roughly $50 million to $ Microcap stock. The term “microcap stock” (sometimes referred to as “penny stock”) applies to companies with low or micro market capitalizations. You should consider investing in microcap stocks because a set of well-chosen microcap stocks can make a real difference to your net worth while keeping. “Microcap stocks” — low-priced stocks issued by the smallest of companies —(sometimes called Penny Stocks) may be difficult to find. microcap stocks listed or permitted to trade on NSE. The index includes the A stock's weight is based on its free-float market capitalization. The Canadian public venture market, the TSX Venture exchange, exists to finance start-ups. Its predecessor, the Vancouver Stock Exchange originally came into. Micro-cap stocks are defined as having a market capitalization between $50 and $ million USD. Other categories are Mega-Cap, Large-Cap, Mid-Cap. Microcap stocks are often considered a risky investment as the companies are small and can go out of business. They also don't have to meet the same minimum. Key Takeaways · A small-cap stock is generally that of a company with a market capitalization of between $ million and $2 billion. · Small-cap stock. What is a microcap stock? Microcap stock describes companies with small or “micro” capitalisations having a market value below US$ million or US$ million. Script error: No such module "Namespace detect". The term microcap stock (also micro-cap) refers to the stock of public companies in the United States which. IBKR defines U.S. Micro-Cap as shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of. MICRO-CAP definition: 1. used to describe a company whose shares have a very small total value: 2. a company whose. Learn more. Then, microcaps stocks generally offer little liquidity. Liquidity is the ability to buy or sell securities quickly, inexpensively and without having a. Microcap stocks, defined as companies with a market value between $50 million to $ million, have traditionally been seen as a “junkyard” by institutional. U.S securities that were purchased on a CommSec International Shares Account which fall below the microcap thresholds can still be sold but may incur.

Hedge Fund Basics

:max_bytes(150000):strip_icc()/what-is-a-hedge-fund-2e6f8b2e1f544a1588abc33bad185991.png)

Hedge funds are an important subset of the alternative investments space. · Hedge fund strategies are classified by a combination of the instruments in which. A hedge fund is generally lightly regulated and combines leverage, short selling, and derivatives with active security selection, macro views, and advance. A hedge fund is a pool of money that is invested in stocks and other asset classes using aggressive and relatively risky strategies to maximize profits. Hedge Fund Fundamentals Course Overview · Define the characteristics associated with a typical hedge fund · Describe the structure of a hedge fund, the services. Regulation of the Fund: The fund itself is regulated under the Company Act, which requires the registration of any “investment company.” Hedge funds have. Open-ended structure: Most hedge fund strategies generally allow investors to purchase or redeem shares in the fund at any time. This means investors can invest. By simple definition, hedge funds are pooled investment vehicles that can invest in a wide variety of products, including derivatives, foreign exchange, and. In this educational series about hedge funds, we go back to basics, looking at what hedge funds are, why investors choose to invest in hedge funds and what. The Fundamentals of Hedge Fund Management, Second Edition shows you how, bringing together everything you need to know to build, maintain, and reap the rewards. Hedge funds are an important subset of the alternative investments space. · Hedge fund strategies are classified by a combination of the instruments in which. A hedge fund is generally lightly regulated and combines leverage, short selling, and derivatives with active security selection, macro views, and advance. A hedge fund is a pool of money that is invested in stocks and other asset classes using aggressive and relatively risky strategies to maximize profits. Hedge Fund Fundamentals Course Overview · Define the characteristics associated with a typical hedge fund · Describe the structure of a hedge fund, the services. Regulation of the Fund: The fund itself is regulated under the Company Act, which requires the registration of any “investment company.” Hedge funds have. Open-ended structure: Most hedge fund strategies generally allow investors to purchase or redeem shares in the fund at any time. This means investors can invest. By simple definition, hedge funds are pooled investment vehicles that can invest in a wide variety of products, including derivatives, foreign exchange, and. In this educational series about hedge funds, we go back to basics, looking at what hedge funds are, why investors choose to invest in hedge funds and what. The Fundamentals of Hedge Fund Management, Second Edition shows you how, bringing together everything you need to know to build, maintain, and reap the rewards.

Hedge funds are gaining in acceptance and popularity. The authoritative and comprehensive Fundamentals of Hedge Fund Investing contains explanations of hedge. A hedge fund collects monetary contributions from its customers and creates portfolios by investing that pool of money across a variety of financial instruments. Hedge funds can take long or short positions in securities. This allows the fund to make returns irrespective of whether the overall market is going up or down. Hedge funds are structured to be partnerships between the manager and the investors. The hedge fund manager will invest an ample amount of his own money in the. Hedge funds employ non-traditional strategies including long and short positions, leveraging, arbitrage, swaps, etc. to manage risk and enhance potential return. A hedge fund is a limited partnership of private investors, whose money is actively managed by professional fund managers. Fund managers may use leverage or. Now in its second edition, The Fundamentals of Hedge Fund Management is revised and updated to address how the credit crisis, legislation, fraud, technology. Hedge Fund Basics · What are Hedge Funds and Who Invests in Them · Organization of Hedge Funds · Regulation of Hedge Funds · The Growth of Hedge. Hedge funds are structured as limited partnerships. The investors are limited partners while the hedge fund company is a general partner. The hedge fund pools. The most common strategies include short-selling, reliance on leverage (i.e. borrowed funds), financial derivative instruments, and arbitrage strategies. Mutual. What are the Distinct Features of a Hedge Fund? · The fund is open to only qualified or accredited investors and cannot be offered or sold to the general public. Like mutual funds, hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible. By employing various strategies such as long-short strategies, hedge funds can adapt to different conditions during the market cycle and provide the. To invest hedge fund money, you have to be something called an accredited investor. In simple terms, you have to already be somewhat wealthy. You need to have a. Hedge funds are investment vehicles that explicitly pursue absolute returns on their underlying investments. The appellation "Absolute Return Fund" would be. Unique to the investment community, hedge funds are partnerships formed between fund managers and investors. Typically hedge fund managers invest a significant. Third, you need to be part of an existing team at a hedge fund, asset management firm, or prop trading firm to have a good chance at starting a new fund. To. At the most basic level, hedge funds are pooled investment vehicles which are largely unconstrained in the investments they can make. They can typically use a. From here, the list goes on to include the basics: legal, regulatory and compliance costs for There are many investors who would like access to more than one.

What Is The Average Premium For Life Insurance

premium's cost and what to consider when buying life insurance If so, your hobbies may cause you to receive higher rates than the average consumer. A $, term life insurance policy costs only $ per month at age 60, compared to $1, for a year term life insurance at 70 years old. What is the. A healthy, year-old woman can expect an average monthly rate of $ A healthy, year-old man can expect an average monthly rate of $ The imputed cost of coverage in excess of $50, must be included in income, using the IRS Premium Table, and is subject to social security and Medicare taxes. In one estimate by Pacific Life analysts for a healthy nonsmoking male, the realities of aging mean that the cost of a year Promise Term Life Policy with. TruStage™ Individual Term Life Insurance Monthly Premiums ; , , The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. We'll run through how life insurance rates are calculated and offer a roundup of the life insurance products Corebridge Direct has to offer along with their. The average cost of a term life insurance premium is around $ a year. 1 The cost of term life insurance can be very affordable. premium's cost and what to consider when buying life insurance If so, your hobbies may cause you to receive higher rates than the average consumer. A $, term life insurance policy costs only $ per month at age 60, compared to $1, for a year term life insurance at 70 years old. What is the. A healthy, year-old woman can expect an average monthly rate of $ A healthy, year-old man can expect an average monthly rate of $ The imputed cost of coverage in excess of $50, must be included in income, using the IRS Premium Table, and is subject to social security and Medicare taxes. In one estimate by Pacific Life analysts for a healthy nonsmoking male, the realities of aging mean that the cost of a year Promise Term Life Policy with. TruStage™ Individual Term Life Insurance Monthly Premiums ; , , The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. We'll run through how life insurance rates are calculated and offer a roundup of the life insurance products Corebridge Direct has to offer along with their. The average cost of a term life insurance premium is around $ a year. 1 The cost of term life insurance can be very affordable.

In this scenario, the monthly term life insurance cost for a year-old non-smoker would be $ A year-old non-smoker would pay a $ monthly premium for. Whole life insurance premiums will be higher, potentially ranging from $ to $ per month for the same coverage. What is the age limit for life insurance? You typically choose a length of time during which your policy premium won't increase — such as 10, 20 or 30 years. After that level premium period, the cost of. What is the Ohio Department of Insurance's role in determining insurance rating plans? The Department does not set insurance rates, nor do we tell an insurance. The average cost of life insurance largely depends on your risk of mortality. This usually means that younger and healthier individuals pay lower rates. Average monthly term life insurance rates ; $ $ ; $ $ ; $ $ ; $ $ Average Life Insurance Cost by Company ; Protective, $, $, $, $ Our most recent Insurance Barometer Study revealed that people think life insurance costs three times more than it really does. Many people were surprised to. This guide explains how the average cost of life insurance UK works and answers the top questions that people ask. You might be wondering how much life insurance costs, and if it's really worth it. As of the average cost of a life insurance policy is $26 a month. The premium rate for a life insurance policy is based on two underlying concepts: mortality and interest. A third variable is the expense factor. Term life insurance rates by age ; Female, 50, $ ; Male, 55, $ ; Female, 55, $ ; Male, 60, $ What should term life insurance cost? The average monthly term life insurance premium for a policy with a duration of ten years is $ per month for. How much insurance do I need? Fill out the easy-to-use life insurance calculator to find out how much additional life insurance you need. The following life insurance calculator and tools will help you decide how much life insurance you may need and the potential costs. Find out why many prefer the value of whole life insurance, see actual rates quoted for people of different ages, and learn about factors that affect cost. The enrollee pays an average cost over the term of their coverage. As For earlier rates see our rates history pages. Rates for Basic Life Insurance. The longer the guarantee, the higher the initial premium. If you die during the term period, the company will pay the face amount of the policy to your. Life insurance might cost less than you think. Find out the average cost of life insurance as well as what factors impact life insurance rates. Level premiums. May be renewable or convertible. Some types of permanent insurance offer flexible premium payments and level or increasing death benefit options.

Pangolin Price

Pangolin (PNG) is worth $ today, which is a % decline from an hour ago and a % decline since yesterday. The value of PNG today is % lower. The live price of Pangolin is $ per (PNG/USD) with a current market cap of $54,, USD. Pangolin's value undergoes frequent fluctuations due to the. Pangolin's price has also fallen by % in the past week. The current price is $ per PNG with a hour trading volume of $K. Currently, Pangolin is. Discover historical prices of Pangolin USD (PNG-USD) on Yahoo Finance. View daily, weekly or monthly formats. PNG price live at $, up % in the last 24 hours. Compare the best PNG prices and latest interest rates from leading platforms, including Coinbase. Depence R3 | Show Control Module. Regular price $4, Depence R3 | Special-FX Module. Regular price $1, Depence R3 | Stage Lighting Module. Pangolin's price today is US$, with a hour trading volume of $, PNG is % in the last 24 hours. It is currently % from its 7-day. Pangolin automatically calculates and sorts products by unit price (weight, volume, or count). The current real time Pangolin price is $, and its trading volume is $, in the last 24 hours. PNG price has plummeted by % in the last day, and. Pangolin (PNG) is worth $ today, which is a % decline from an hour ago and a % decline since yesterday. The value of PNG today is % lower. The live price of Pangolin is $ per (PNG/USD) with a current market cap of $54,, USD. Pangolin's value undergoes frequent fluctuations due to the. Pangolin's price has also fallen by % in the past week. The current price is $ per PNG with a hour trading volume of $K. Currently, Pangolin is. Discover historical prices of Pangolin USD (PNG-USD) on Yahoo Finance. View daily, weekly or monthly formats. PNG price live at $, up % in the last 24 hours. Compare the best PNG prices and latest interest rates from leading platforms, including Coinbase. Depence R3 | Show Control Module. Regular price $4, Depence R3 | Special-FX Module. Regular price $1, Depence R3 | Stage Lighting Module. Pangolin's price today is US$, with a hour trading volume of $, PNG is % in the last 24 hours. It is currently % from its 7-day. Pangolin automatically calculates and sorts products by unit price (weight, volume, or count). The current real time Pangolin price is $, and its trading volume is $, in the last 24 hours. PNG price has plummeted by % in the last day, and.

Pangolin. Pangolin - Price list. prices incl. taxes and VAT. Code, Name. Catalogue price. Your net price. Unit. pgl-BEYOND-adv(lifetime,account), BEYOND. Pangolin price is $, up % in the last 24 hours, and the live market cap is $57,, It has circulating supply of ,, PNG coins and a max. PNG price today is $, with a live price change of in the last 24 hours. Convert, buy, sell and trade PNG on Bybit. Get the latest and historical Pangolin price, PNG market cap, trading pairs, and exchanges. Check the charts, PNG to USD calculator. Learn what Pangolin (PNG) cryptocurrency is and today's market price. Confidently invest in cryptocurrency with current and historical Pangolin market data. Access real-time PNG to USD rates and explore today's Pangolin price with live updates, user-friendly charts, news forecasts and market cap data. View the Pangolin (PNG) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. Pangy the Pangolin: Marika Price, Zach Spitulski: Books - alienexpress.ru net's forecasts the coin's price to go above $ by December. Forecasting Pangolin's future, WalletInvestor expects further growth, too, saying the Pangolin. Pangolin PNG price graph info 24 hours, 7 day, 1 month, 3 month, 6 month, 1 year. Prices denoted in BTC, USD, EUR, CNY, RUR, GBP. The current price of Pangolin is $ Discover PNG price trends, charts & history with Kraken, the secure crypto exchange. Find the latest Pangolin Diamonds Corp. (PAN.V) stock quote, history, news and other vital information to help you with your stock trading and investing. When threatened, pangolins curl into a ball, using the scales as armor to defend against predators. The scales can cost more than $3,/kg on the black market. According to our Pangolin price prediction, PNG is forecasted to trade within a price range of $ and $ next year. Pangolin will increase by. Market analysts and experts predict say that Pangolin Price Prediction and technical analysis, Pangolin is expected to cross a price level of $ in The average reported price in the PA was 12, NPR/kg (USD $/kg) in and 18, NPR/kg (USD $/kg) in ; in the non-PA, the cost per kg of pangolin. Our technical analysis forecasts that the Pangolin price will not hit $, in a year. The current 1-year PNG price prediction by our metrics is $ If. Pangolin Price Today US - Check the latest Pangolin price, PNG live chart, market cap, trading volume, latest Pangolin news, total circulating supply etc. Regular price $ FB4 External System. Regular price $1, Pangolin FB4-XE with QuickShow. FB4 Standard with QuickShow. Regular price $ The live price of Pangolin is $ per (PNG/USD) with a current market cap of $54,, USD. Pangolin's value undergoes frequent fluctuations due to the.

Fibo Retracement

To use the Fibonacci retracements, you have to first identify an 'A to B' move where you can use the Fibonacci retracement tool. What do we mean with 'A to. Each percentage depicts how much of a prior move the price has retraced. In cTrader the default Fibonacci retracement levels are 0%, %, 50%, %, and %. The Fibonacci retracement tool plots percentage retracement lines based upon the mathematical relationship within the Fibonacci sequence. Many traders use Fibonacci ratios to calculate support and resistance levels in their forex trading strategies. The Fibonacci retracement level tends to act as a capitulation price level where anyone who was going to stop-out of a position has been stopped out or. Fibonacci Retracement + Support and Resistance. One of the best ways to use the Fibonacci retracement tool is to spot potential support and resistance levels. Fibonacci retracement levels are a useful tool that can help you determine how much of a move in a given part of the main trend will retrace before that. Figure 1: RETRACE AND EXTEND. Retracement numbers are set at key levels starting from the high price of the sample stock. If the stock were to fall beyond the. Fibonacci retracements are an important element of Elliott Wave Theory. Being a combination of a trendline with several horizontal levels (distant from each. To use the Fibonacci retracements, you have to first identify an 'A to B' move where you can use the Fibonacci retracement tool. What do we mean with 'A to. Each percentage depicts how much of a prior move the price has retraced. In cTrader the default Fibonacci retracement levels are 0%, %, 50%, %, and %. The Fibonacci retracement tool plots percentage retracement lines based upon the mathematical relationship within the Fibonacci sequence. Many traders use Fibonacci ratios to calculate support and resistance levels in their forex trading strategies. The Fibonacci retracement level tends to act as a capitulation price level where anyone who was going to stop-out of a position has been stopped out or. Fibonacci Retracement + Support and Resistance. One of the best ways to use the Fibonacci retracement tool is to spot potential support and resistance levels. Fibonacci retracement levels are a useful tool that can help you determine how much of a move in a given part of the main trend will retrace before that. Figure 1: RETRACE AND EXTEND. Retracement numbers are set at key levels starting from the high price of the sample stock. If the stock were to fall beyond the. Fibonacci retracements are an important element of Elliott Wave Theory. Being a combination of a trendline with several horizontal levels (distant from each.

Learn how you can use Fibonacci retracement lines to spot potential patterns in price charts. Fibonacci retracement levels are support and resistance levels that are based on the Fibonacci numbers. Those are %, %, %, and %. When drawing. Fibonacci retracement levels are horizontal lines on a price chart that show potential support and resistance levels in price movement. Fibonacci Retracement Levels · %: Often considered the shallowest retracement level, it represents a minor pullback in the price. · %: This level is. Using Fibonacci retracement levels can help traders identify support and resistance price levels in stocks. Introduction The Fibonacci Retracement tool is a go-to for traders looking to spot potential support and resistance levels. By measuring the distance between. The Fibonacci ratios, ie %, %, and %, help the trader identify the retracement's possible extent. The trader can use these levels to position. Fibonacci retracements are a set of ratios, defined by the mathematically important Fibonacci sequence, that allow traders to identify key levels of support. The Fibonacci retracement strategy helps traders pinpoint potential support and resistance levels, which are crucial for determining price movements and setting. Fibonacci retracement levels are horizontal support and resistance levels located at a fixed distance, which is calculated using a coefficient. They are simply. Fibonacci calculator for generating daily retracement values - a powerful tool for predicting approximate price targets. Fibonacci retracement analysis can be used to confirm an entry-level, target a take profit as well as determine your stop loss level. The Fibonacci retracement strategy helps traders pinpoint potential support and resistance levels, which are crucial for determining price movements and setting. Using Fibonacci retracement in day trading. Fibonacci retracement can be used as the basis for typical strategies employed by a day trader to ensure a stable. Fibonacci retracements are a popular form of technical analysis used by traders in order to predict future potential prices in the financial markets. Fibonacci Retracement + Support and Resistance. One of the best ways to use the Fibonacci retracement tool is to spot potential support and resistance levels. The Fibonacci Retracement is a tool designed to identify support and resistance levels during a pullback within a trend or swing. Fibonacci retracements are a technical analysis tool used in trading to identify potential levels of support and resistance in an asset's price movement. Fibonacci retracements are a set of ratios, defined by the mathematically important Fibonacci sequence, that allow traders to identify key levels of support.

Study Abroad After 40

At St. John's, over 40% of undergraduates study abroad, making us a national leader in international engagement. We offer programs throughout the world that. UD offers + programs in about 40 countries-- and over 30 percent of UD undergrads study abroad at least once! Six Reasons Why It's Never Too Late To Study Abroad · 1. Many flexible programs are designed for adults. · 2. The experience may boost your career. · 3. You are. A group of students marvels at a historical site in Greece. Santiago. Beijing. Paris. Oslo. Experience the world from multiple perspectives through our. Study abroad at one of over 40 partner universities as part of your degree. Live and study abroad for a year to expand your horizons, network and career. Most US colleges and universities have education abroad offices that will help connect you with a study abroad or exchange program, either facilitated by. We offer more than 90 semester and academic year programs, and 20 - 25 summer programs in 40+ countries around the world. After these forms are completed and School for International Training (SIT) is a study abroad provider with programs and internships in 40 countries. At St. John's, over 40% of undergraduates study abroad, making us a national leader in international engagement. We offer programs throughout the world that. At St. John's, over 40% of undergraduates study abroad, making us a national leader in international engagement. We offer programs throughout the world that. UD offers + programs in about 40 countries-- and over 30 percent of UD undergrads study abroad at least once! Six Reasons Why It's Never Too Late To Study Abroad · 1. Many flexible programs are designed for adults. · 2. The experience may boost your career. · 3. You are. A group of students marvels at a historical site in Greece. Santiago. Beijing. Paris. Oslo. Experience the world from multiple perspectives through our. Study abroad at one of over 40 partner universities as part of your degree. Live and study abroad for a year to expand your horizons, network and career. Most US colleges and universities have education abroad offices that will help connect you with a study abroad or exchange program, either facilitated by. We offer more than 90 semester and academic year programs, and 20 - 25 summer programs in 40+ countries around the world. After these forms are completed and School for International Training (SIT) is a study abroad provider with programs and internships in 40 countries. At St. John's, over 40% of undergraduates study abroad, making us a national leader in international engagement. We offer programs throughout the world that.

Study abroad away for a few weeks, a semester, or an academic year. Choose from + programs in 40+ countries After You're Admitted · Non-Degree. Salve Regina approves more than study abroad programs in more than 40 countries around the world. Read more. Our students can choose from more than study abroad offerings in more than 40 Learn More About Study Abroad at Salve Regina. Salve Regina University. UCEAP is the University of California's official study abroad program, offering a wide variety of summer, semester, and year options in over 40 countries. We often talk about the profound benefits of studying abroad. Think that ship has sailed if you are not a traditional college student? · 1. Many flexible. A group of students marvels at a historical site in Greece. Santiago. Beijing. Paris. Oslo. Experience the world from multiple perspectives through our. Our students can choose from more than study abroad offerings in more than 40 Learn More About Study Abroad at Salve Regina. Salve Regina University. Nationally, the number of U.S. students studying abroad for credit during the academic year rebounded to more than half of pre-pandemic levels. at the end of the semester immediately preceding their study abroad experience. study abroad provider with programs and internships in 40+ countries. Current UBC students can apply to study abroad at over of UBC's partner schools in 40 countries. semester or a year of study at a partner university. Studying abroad has lifelong benefits. Evidence shows that students who study abroad generally perform better in college than their peers. They gain confidence. Education Abroad offers over approved study abroad programs in over 40 countries around the world; students can spend a summer, a semester, or a full. The statistics show that studying abroad increases the chances of successful employment. After graduation, 74% of college students reported starting a. John's, over 40% of undergraduates study abroad, making us a national leader in international engagement. News. Global After Graduation Panel Offer. Providence College recognizes over study abroad programs in more than 40 countries around the world! After Study Abroad , if you have more questions. 84%. of study abroad alumni felt their studies abroad helped them build valuable skills for the job market. (4) A second study confirms this at 85%. (10) ; 40%. Through the study abroad and exchange programmes students are able to spend one or two semesters studying at the University of Leeds, and can transfer. You can also take courses or do research abroad in the summer for a few weeks. Where can I go and what can I study? You will find learning abroad opportunities. Your international education experience doesn't have to end after studying abroad. There are many ways to continue your experience through work and. summer and semester programmes at UK universities. Learn more about studying overseas 92 Global offices in 40 countries. Home · Find a course; UK Study.

Can You Invest In The S&P 500

5 steps for how to invest in the S&P for beginners, plus 3 strategies to invest in one of the world's most popular stock market indexes. Why invest in RSP? Twenty years ago, the Invesco S&P Equal Weight ETF (ticker: RSP) helped reinvent how clients access the S&P If you're invested in. What the S&P might mean for you. If you own individual large-cap stocks, you may likely be invested in one or more companies listed on the index. Many index. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k). As we've said, a total stock market index fund encompasses a wider universe of stocks than does the S&P , but the difference might not be as great as you. investment. You can't invest in an index. Standardized returns: To see quarterly fee-adjusted returns, refer to the Price & Performance details. Expense. Looking out just one year from each all-time high in the S&P , market corrections greater than 10% have occurred only 9% of the time. · As we extend the time. S&P CFD. Nowadays, everyone is given the chance to buy not the index itself but its Contract for Difference (CFD). This is a good opportunity for beginning. 5 steps for how to invest in the S&P for beginners, plus 3 strategies to invest in one of the world's most popular stock market indexes. Why invest in RSP? Twenty years ago, the Invesco S&P Equal Weight ETF (ticker: RSP) helped reinvent how clients access the S&P If you're invested in. What the S&P might mean for you. If you own individual large-cap stocks, you may likely be invested in one or more companies listed on the index. Many index. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k). As we've said, a total stock market index fund encompasses a wider universe of stocks than does the S&P , but the difference might not be as great as you. investment. You can't invest in an index. Standardized returns: To see quarterly fee-adjusted returns, refer to the Price & Performance details. Expense. Looking out just one year from each all-time high in the S&P , market corrections greater than 10% have occurred only 9% of the time. · As we extend the time. S&P CFD. Nowadays, everyone is given the chance to buy not the index itself but its Contract for Difference (CFD). This is a good opportunity for beginning.

Sharesies: Sharesies is still one of the most popular share trading platforms in NZ, despite its fee hike in early You can also invest in ETFs, including. The S&P index is home to the largest, most influential stocks in the United States. Learn more about how trade in the S&P on this page. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. Instead, you could gain this broad exposure through an ETF that tracks the S&P Index. This investment should closely mirror the performance of the. The S&P is one of the most widely-followed stock market indices in the world and there are many funds that invest based on the index. These five stand out. An investor cannot buy the actual S&P The S&P is an index or benchmark; however, you may consider mutual funds or Exchange Traded Funds. The S&P is widely used to (i) direct capital through “passive” investing, (ii) benchmark investment portfolios, and (iii) evaluate firm performance. If you still want to be exclusively invested in the US, but want a more balanced exposure, you could consider an equally weighted S&P ETF, which holds every. The introduction of the NFO (new fund offer) allows Indian investors to invest in US stocks in a flexible manner. Even small investors can invest in the top. S&P trading is available on our xStation trading platform and you can start trading some of the American largest companies by entering into CFD (contract. If you want to invest in the S&P , you first need a brokerage account. This can be a retirement account such as a traditional IRA or Roth IRA. SSGA Funds are available through most major broker/dealer and supermarket platforms. If you are an investment advisor and have questions regarding platform. The S&P index is home to the largest, most influential stocks in the United States. Learn more about how trade in the S&P on this page. Looking out just one year from each all-time high in the S&P , market corrections greater than 10% have occurred only 9% of the time. · As we extend the time. It comprises stocks of companies selected by a committee using 8 criteria. While the index is diversified, investing only in an S&P index fund will. You can't invest directly in the S&P , or any stock market index, because they are nothing more than company lists. However, you can invest in index funds. “A low-cost index fund is the most sensible equity investment for the great majority of investors.” Warren Buffett. The rise of index investing. Index investing. 2. Dividend and Income-Focused S&P ETFs: · ProShares S&P Dividend Aristocrats ETF (NOBL) - Managed by ProShares: Invests in S&P companies with a. It comprises stocks of companies selected by a committee using 8 criteria. While the index is diversified, investing only in an S&P index fund will. Yes. There are several ways to do this, but the most common is through a mutual fund or exchange-traded fund (ETF). Another way to invest.